Question

Cool Meals (CM)

Cool Meals (CM) produces frozen organic ready-made meals that are sold to food retailers throughout the country.

CM buys large quantities of organic ingredients from local farmers for its just-in-case (JIC) stock control management. It uses a cost-plus (mark-up) pricing strategy.

$C M$ is known for its:

- good-quality organic frozen meals, which are perceived as good value for money

- flexibility with retailers in terms of quantity of meals supplied, credit given and efficient delivery at pre-arranged dates

- corporate social responsibility (CSR) based on a long-term commitment made to farmers to purchase large quantities of organic ingredients every four months and pay a fair price promptly

- $C M$ has an excellent working relationship with farmers, who always prioritize CM’s requests in terms of quantity and delivery.

Recently, an economic downturn and increased competition, especially from non-organic frozen meal suppliers, has decreased demand for frozen organic meals.

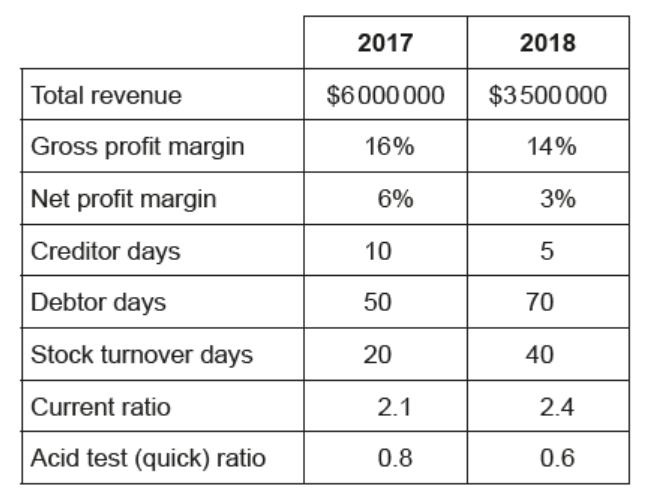

The finance manager of $C M$, Kayleigh, provided the following financial information.

Table 1: Selected financial information for $C M$

Kayleigh is worried about the cash flow of $C M$ and suggested the company changes the stock control method from just-in-case (JIC) to just-in-time (JIT). She is also looking at other strategies to improve CM’s financial position.

a. Define the term corporate social responsibility (CSR).[2]

b. Explain one advantage and one disadvantage for $C M$ of using a cost-plus (mark-up) pricing strategy.

c. Explain one advantage and one disadvantage for CM of changing its stock control method from just-in-case (JIC) to just-in-time (JIT).$[4]$

d. Using the financial information in Table 1, evaluate two strategies that $C M$ could use to improve its financial position other than changing to a just-in-time (JIT) stock control method. $[10]$

▶️Answer/Explanation

Ans:

a.

CSR is the decision/attempt by a business to take responsibility for their action/activities by considering the interests of and the impact on a wide range of stakeholders in society. The business accepts the moral and legal obligations to society, not just to investors, that result from its operation.

Candidates are not expected to word their definition exactly as above.

Award [1] for a basic definition that conveys partial knowledge and understanding similar to the above answer. The first mark would typically come from awareness that there is some morale guidance.

Award [2] for a full, clear definition that conveys knowledge and understanding similar to the answer above. Individual stakeholders do not need to be named to gain full marks.

Do not credit an example.

b.

One advantage for CM of using a cost-plus pricing strategy is the fact that it will be CM that covers all the costs and ensures a certain percentage of profit to be made. It is evident given the figures above that CM makes a profit. CM’s ability to make a profit ensures long-term survival. CM’s meals are perceived as good value for money, hence the strategy is effective.

Given the increase in competition, CM can be flexible and reduce the margin set above the costs. Flexibility in pricing is an important factor when there is an economic downturn, as well as increased competition.

A possible disadvantage is that CM’s costs are likely to be higher than competitors who supply non-organic meals. Together with the customers’ unwillingness to pay a premium price during an economic downturn, CM might see a further fall in demand as seen in the fall in total revenue in 2018.

Accept any other relevant advantage / disadvantage.

Award [1] for each role identified and an additional [1] for development with application to CM. Award a maximum of [2] per advantage/disadvantage. [2] cannot be awarded per role if the response lacks either explanation and / or application.

For example:

For an identification or a description of an advantage/ disadvantage with or without application [1].

For explanation of relevant advantage/ disadvantage with no application [1].

For explanation of a relevant advantage/ disadvantage and application [2].

c.

A possible advantage for CM of changing the stock method from JIC to JIT:

As CM buys agriculture produce/ stock, these products need to be well stored and possibly refrigerated. Moving to JIT will significantly reduce costs of storage and spoilage. The gross profit margin, which has fallen by 2 %, is likely to increase rather than decrease. The very high current ratio of 2.4 will fall, as CM will not stock financially unproductive assets.

A possible disadvantage for CM of changing production /stock method methods from JIC to JIT:

Given the nature of the industry, the farmers are likely to prefer CM buying large quantities seasonally. Ordering lower quantities when needed might create problems/costs for the farmers, who might not prioritize CM any longer. CM will also lose its reputation for CSR based on long-term commitment to farmers to buy large quantities.

Moreover, given the unpredictable nature of farming, not having buffer stock could result in CM being out of stock with the consequences of losing clients/reputation and therefore revenue and profit. CM is likely to lose its reputation for flexibility with the retailers in terms of quantity and delivery if not enough agriculture produce is available.

Accept any other relevant/applicable advantage / disadvantage.

Award [1] for each advantage / disadvantage identified and an additional [1] for development with application to CM. Award a maximum of [2] per advantage / disadvantage.

[2] cannot be awarded per role if the response lacks either explanation and / or application.

For example:

For an identification or a description of an advantage/ disadvantage with or without application [1].

For explanation of a relevant advantage/ disadvantage with no application [1].

For explanation of a relevant advantage/ disadvantage and application [2].

d.

Refer to Paper 2 markbands for 2016 forward, available under the “Your tests” tab > supplemental materials.

It is expected that candidates make constant reference to/use of the figures and other relevant information in the stimulus combined with theoretical understanding of the advantages and disadvantages of the possible strategies.

Some of the possible strategies:

Reduce cash outflow. CM is facing cash flow crisis as seen by its deteriorating acid test ratio of 0.6. Without stock, which contributed to a high current assets ratio, CM cannot meet its long-term liabilities. It is evident that there is a big difference between debtors and creditors days. CM paid the farmers within five days in 2018, which is very quick and got significantly quicker – twice as fast – but received money from the retailers after 70 days in 2018, a significant increase from 50 days. CM is too generous to retailers with the credit term. Despite the fact that the relationship with retailers and the suppliers is CM’s competitive advantage, it is financially dangerous given the decreasing and very low acid test.

Seek alternative suppliers with cheaper agriculture produce might be seen as an extreme solution, as CM’s relationship with the farmers and the quality of the organic ingredients are key to its competitive advantage. It might take a long time to find different suppliers. Perhaps agreeing a longer credit term would be a better solution. Currently, CM pays after five days. One can assume that the farmers are likely to prefer a request for a longer pay period than a more drastic one.

Cut expenses. Gross profit margin is considerably higher than net profit margin for a manufacturing company and is getting worse over time. CM should look at some unnecessary expenses like marketing or administration. However, cutting salaries or staff might impact on the employees’ motivation and cutting marketing might create some difficulties in competing with the new competitors. However, going out of business due to lack of cash can be judged as a more significant threat.

Do not accept better stock control due to JIT.

Tighter credit control. Cash payments only for the retailer will clearly reduce/eliminate debtor days. The acid test ratio is worrying and CM must take immediate actions to solve this short-term liquidity problem. However, the relationship with the retailers might deteriorate and they might start buying non-organic frozen food from the emerging competitors. It appears that CM’s bargaining power with the retailer is weak and this option is unlikely to be successful. One, however, may argue that increasing the creditor days is unlikely to be met with much objection from its suppliers given the very low starting figures and long-established trust. CM might also be able to ask its debtors – the retailers – to pay sooner, even after two months, a demand which is likely to be seen as reasonable.

Changing pricing policy. CM can possibly reduce the price of its products. While CM may be more competitive and this strategy may work well given the economic downturn and the increased competition, CM may suffer losses or a reduction in profit. However, customers may perceive the frozen organic meals as even better value for money and increase demand. Moreover, perhaps CM can withstand a reduction in profit in the short term and we can see that CM is profitable. The liquidity issue ought to be sorted. CM should prioritize its cash flow problem first, then deal with a low acid test to generate cash to survive.

Enhance marketing to generate more sales in cash. CM might be able to reduce its increasing level of stock and reduce stock turnover in days, which has clearly deteriorated considerably from 20 to 40 days. However, any type of promotion may incur more expenses, especially in cash. The data indicates that the net profit margin is considerably lower than the gross profit margin, which indicates that CM does not control its expenses well.

Improved product portfolio. Perhaps CM should also consider non-organic meals or other types of products to enhance its portfolio and create more revenue streams. However, cannibalism can be created – CM may also have to compete more directly with the increasing number of providers of non-organic frozen meals. Market research has to be done so perhaps this option is not the most appropriate one in the short term.

Seeking alternative short term sources of finance. Accept relevant applicable suggestions like the use of overdraft and short-term loans, to deal with CM’s short-term liquidity crisis. However, these options are more of first aid rather than solution to some ongoing problems and are likely to be more theoretical given the lack of information in the stimulus.

It is not expected that the candidates cover all of the above.

Accept any other relevant arguments for and against any relevant suggested strategy.

Accept any other relevant examination.

A conclusion with judgment is expected.

A balanced response covers at least one argument for and one argument against each of two different strategies.

Marks should be allocated according to the paper 2 markbands for May 2016 forward with further guidance below.

For one relevant issue that is one-sided, award up to [3]. For more than one relevant issue that is one-sided, award up to a maximum of [4].

Award a maximum of [6] if the answer is of a standard that shows balanced analysis and understanding throughout the response with reference to the stimulus material but there is no judgment/conclusion.

Candidates cannot reach the [7–8] markband if they give judgment/conclusions that are not based on analysis/explanation already given in their answer.

It is expected that the candidate goes beyond just providing some relevant arguments for or against any suggested strategy and finish off with some conclusions and judgment.

Award a maximum of [4] marks if the answer, regardless of balance and judgment makes no reference to either the figures or headings in Table 1.

Candidates, in order to reach to the top markband, should show clear evidence of substantiation/well supported.

For the top markband, candidates must make use of the financial information given in their discussion.

Question

Fort Industries (FI)

Fort Industries $(F I)$ manufactures aircraft. Jacques Fort founded the business in 1957 as a private limited company. He owned 100 \% of the shares and managed the company strictly, making most of the decisions himself. FI grew through both internal and external growth. Later, it began to manufacture aircraft parts for other manufacturers.

Jacques led his workforce by using Taylor’s motivation theory. He regularly set clear objectives and monitored his employees carefully. Employees had to meet international quality and safety standards. Although Jacques was controlling, employees had job security and believed that he had their best interests at heart.

FI became a public limited company in 1988 and grew. Jacques found this transition difficult. He liked privacy and rarely spoke to the media. This had to change. Employees also began to ask for less supervision, wider spans of control and greater control over quality standards. Jacques retired in 2000 and his son, Henri, took over as CEO. Henri consults widely with his executive team and line managers on all decisions.

Recently, FI has been struggling with liquidity. Henri implemented strict cost controls and analysed the following ratios (see Table 5).

Table 5: Liquidity ratios for $F I$ for 2019 and 2020 and industry averages for 2020

Often, $F I$ has to delay payment to creditors. Employees are concerned that by saving money, safety standards at $F I$ have been reduced.

Henri is considering two options to solve the liquidity problem:

- Option 1: A long-term loan.

- Option 2: Issuing and selling additional shares in FI.

a. State two types of external growth.[2]

b. Explain one advantage and one disadvantage for FI of motivating its employees using Taylor’s motivation theory.$[4]$

c. Explain two reasons why Jacques may have found the transition difficult when FI became a public limited company.$[4]$

d. Recommend whether Henri should choose Option 1 or Option 2.[10]

▶️Answer/Explanation

Ans:

a. Types of external growth include:

- Mergers

- Acquisitions

- Strategic alliances

- Joint ventures

- Franchising

Award [1] for each type of external growth up to [2]. Maximum award: [2].

b.Taylor’s motivation theory will clearly have advantages for FI.

Advantages:

- Setting ‘specific targets’ enhances production levels for FI

- Having ‘close monitoring’ enables better control for FI

- Due to the ‘close monitoring’ quality standards can be maintained and errors reduced

- Limited consultation enables quicker decisions by management

- Careful planning of tasks allow optimal use of resources for FI.

Disadvantages:

- The need to ‘monitor closely’ requires more management/supervisory time

- Reducing all tasks to fixed routines reduces flexibility

- Using Taylor does not allow team working which might otherwise give efficiency benefits

- Does not encourage creativity and new ideas for production methods

- There is clearly potential stress under this motivational regime. Pressure to perform and meet international quality and safety standards. This could be demotivating for some workers and it could increase staff turnover at FI.

Award [1] for a theoretical response with an additional mark for application to FI.

Do not reward candidates who argue the advantages/disadvantages from the point of view of the worker and NOT the company.

Mark as a [2+2].

When FI became a public company, Jacques’s situation changed. As a largely autocratic leader, he had not ever had to explain his decisions to anyone. He was in control. Now that he is the head of a public limited company with many shareholders, he had to explain his decisions to a board of directors that he had not personally selected.

As head of a privately held company, Jacques could use company resources as he saw fit. If he made a poor decision and it hurt the finances of the company, he was only hurting himself. Now, as head of a publicly traded company, he has a fiduciary responsibility with the resources of the company. All resources should be used judiciously with the aim of improving the return to shareholders.

As a public limited company, FI was subject to greater media scrutiny, which meant that any issue or problem was potentially subject to public viewing through the press. Jacques had always valued privacy. He largely controlled what information got to the press. Now as head of a publicly traded company, FI had to adopt an aggressive public relations strategy as a way to minimize informational risk and maximize shareholder value.

Accept any other valid and relevant reason Jacques may have found the transition difficult.

Mark as [2 +2].

Award [1] for identification of a reason he may have found the transition difficult and an additional [1] for explanation and application.

Refer to Paper 2 markbands for 2016 forward, available under the “Your tests” tab > supplemental materials.

The advantages of long-term debt are that FI gets money now and the repayment is over many years. Ownership is not affected by long-term debt, and, for a company as old and established as FI, financing from banks or other financial institutions would probably not be that hard to obtain.

The disadvantages of long-term debt are that interests costs will rise, which increases outflows and liquidity will decrease. Additionally, the bank may put some restrictions on FI in the loan agreement which might limit future liquidity solutions in the future.

The alternative method, issuing and selling additional shares of stock, has the advantage that it would raise equity, which has no interest payments. Thus, FI could raise money and invest it in current assets such that it could start taking trade and other discounts. Liquidity through increased cash inflow would improve.

The main disadvantage is that the ownership of FI would be diluted. The Fort family would own a lesser percentage of the company than they currently do. Further, with greater equity, return on capital employed ratios would probably initially go down. Stakeholders will be concerned by this perceived fall in profitability.

Any other strategies probably would not be appropriate or enough to fix the problems. Tinkering around with the composition of current assets is unlikely to make much of a difference. Presumably, FI turns its inventory as fast it can. Making debtors pay more quickly is not very likely to occur, as they will resist. This move could give FI’s competitors a competitive advantage if competitors do not alter payment terms.

“Balanced” means that the candidate has provided at least one argument for and one arguments against for each option.

Marks should be allocated according to the paper 2 markbands for May 2016 forward.

Candidates may contrast one option with another for a balance as long as at least two arguments are given for each option.

Award a maximum of [6] if the answer is of a standard that shows balanced analysis and understanding throughout the response with reference to the stimulus material but there is no judgment/conclusion.

Award a maximum of [6] if the answer makes no reference to the quantitative data in the question.

Candidates cannot reach the [7–8] markband if they give judgment/conclusions that are not based on analysis/explanation already given in their response.