Question

Ritev Enterprises (RE)

Ritev Enterprises (RE) is a public limited company that owns a chain of 20 gas (petrol) stations. Next year, RE plans to modernize its gas stations by installing self-service pumps.

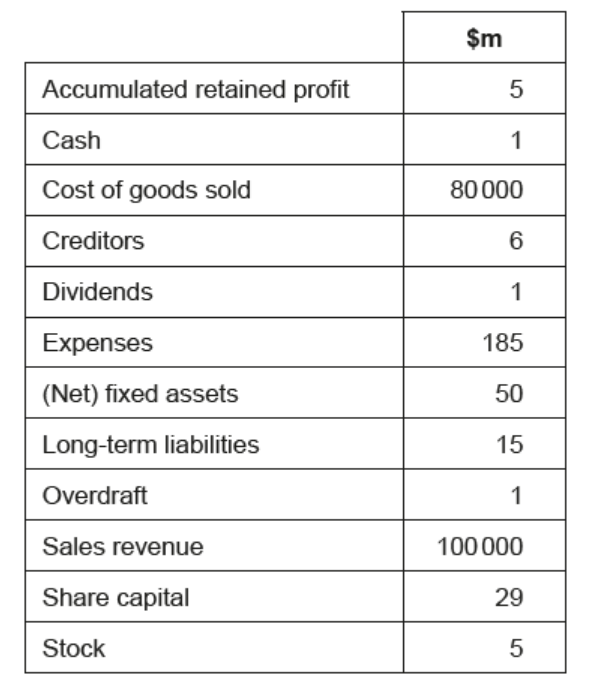

Table 2 provides selected financial data for RE from:

the profit and loss account for year ending 31 May 2021

the balance sheet as of 31 December 2021.

Table 2: Selected financial data for RE

The finance director is concerned about the trend in consumer preference for electric cars and the potential impact of increased numbers of electric cars on $R E$.

a. State two appropriate external sources of finance that $R E$ could use to modernize its gas stations.[2]

b.i. Construct a fully labelled balance sheet for $R E$ as of 31 December 2021 .[5]

b.ii.Calculate $R E$ ‘s gross profit margin (no working required).[1]

▶️Answer/Explanation

Ans:

a.Award [1] for each appropriate source of finance up to a maximum of [2].

Appropriate external sources include:

- share (capital)

- loan (capital) / bank loans

- retained profit

- debentures

- venture capital

- leasing

- equity finance.

Do not award inappropriate sources such as:

- trade credit

- overdrafts

- grants

- subsidies

- debt factoring

- hire purchase

- business angels

- partners

- entrepreneur.

b.i

N.B. if the candidate does not follow the IB prescribed format award a maximum of [3].

N.B. candidates should not be penalized for: omitting the row “Long-term liabilities (debt)”, or for writing “retained profit” omitting the word “accumulated”.

Award [1] if the candidate conveys some idea of what a balance sheet is.

Award [2] if the candidate constructs a largely recognizable balance sheet, but it does not balance, or it has two major problems of classification.

Award [3] for a largely accurate balance sheet that correctly balances. (There could be one misclassification.)

Award [4] if the candidate constructs an accurate balance sheet (that balances) according to the IB prescribed format.

Award [5] if the candidate constructs an accurate balance sheet (that balances) according to the IB prescribed format and the balance sheet is dated.

b.ii. $\$ 100000 m-80000 m=\$ 20000 m$

$

\frac{\$ 20000 \mathrm{~m}}{\$ 100000 \mathrm{~m}}=20 \%

$

Correct answer $=20 \%$ or .2

If a candidate does not express the gross profit margin (GPM) as a percentage or as a decimal, the answer is incorrect.

Award [1] for the correct answer (no working required).

Question

AXL

AXL has two factories, in which it manufactures aluminium cans for the soft drinks industry.

AXL has a maximum production capacity of 80 million cans per year.

Table 1: AXL’s forecasted sales revenue and costs for 2023

AXL plans to close its two factories and move production to a new, larger factory to obtain economies of scale.

In the first six months of 2022, increased competition led to a fall in AXL’s sales. For the final two months of 2022, AXL plans to increase the trade credit period it offers to customers from 30 to 60 days.

a. Define the term economies of scale. [2]

b.i. Using Table 1, calculate the contribution per unit (show all your working). [2]

b.ii.Using Table 1, calculate the break-even level of output (no working required). [1]

c.i. If $A X L$ produces 75 million cans in 2023, using Table 1, calculate the margin of safety (no working required). [1]

c.ii.lf AXL produces 75 million cans in 2023, using Table 1, calculate the profit (show all your working). [2]

d. Explain the potential impact on $A X L$ if it implements its planned increase in trade credit period. [2]

▶️Answer/Explanation

Ans:

a. Economies of scale are the reductions in unit/average costs that result from an increase in output / increase in scale.

Candidates are not expected to word their definition exactly as above.

Do not reward examples of economies of scale e.g. purchasing economies.

To be awarded [2] candidates must include references to both reductions in costs and the scale of output.

Award [1] for a basic definition that conveys partial knowledge and understanding.

Award [2] for a full definition that conveys knowledge and understanding similar to the answer above.

N.B. no application required. Do not credit examples.

b.i Unit contribution = selling price − variable costs.

Selling price = $0.15

Variable costs = $0.05

Answer = $0.10

Award [2] for a correct answer with working.

Award [1] for correct answer without working.

Award [1] for correct method with an error in the calculation.

b.ii Correct answer = 50m

Award [1] for correct answer without working.

Candidates that omit the million or m sign award [0].

c.i. MOS = current output − break even

= 75m − 50m = 25m

Award [1] for correct answer without working.

Candidates that omit the million or m sign award [0].

If candidates have a dollar sign ($) by the figure, award [0] (for example, the candidate writes $25m).

Allow candidate own figure rule (OFR). A mark can be awarded if an error made in b(ii) is carried through to (c)(i)

c.ii. Output = 75 million cans

TFC = $5m

TVC = $3.75m (75m x 0.05)

TC = $8.75m

TR = $11.25m

Profit = $2.5m

Award [1] for the correct working and [1] for the correct answer.

Award [1] for the correct answer without working.

Answers that omit the m or millions cannot be awarded full marks – a correct answer without the m or millions can be awarded [1] if the method / working is correct.

d. Trade credit is an agreement between businesses that allows the buyer of goods or services to pay the seller at a later date.

Candidates need to show an understanding of trade credit for [1] and make use of the stimulus for [2].

For example, this change may reverse the decline in sales that occurred in the first half of 2022, as now customers have longer to pay, which makes the business more competitive in an increasingly competitive market.

However, a comment such as “It may lead to an increase in sales but a reduction in cash inflows as AXL’s existing customers can now delay payment for an additional 30 days” has only nominal application, as the comment applies to almost all non-retail companies. In this instance, award [1].

Award [1] for only a partial/unclear explanation of the impact on AXL.

Award [2] for a clear explanation of the impact on AXL that makes use of the stimulus provided.