Question

Ritev Enterprises (RE) is a public limited company that owns a chain of 20 gas (petrol) stations. Next year, RE plans to modernize its gas stations by installing self-service pumps.

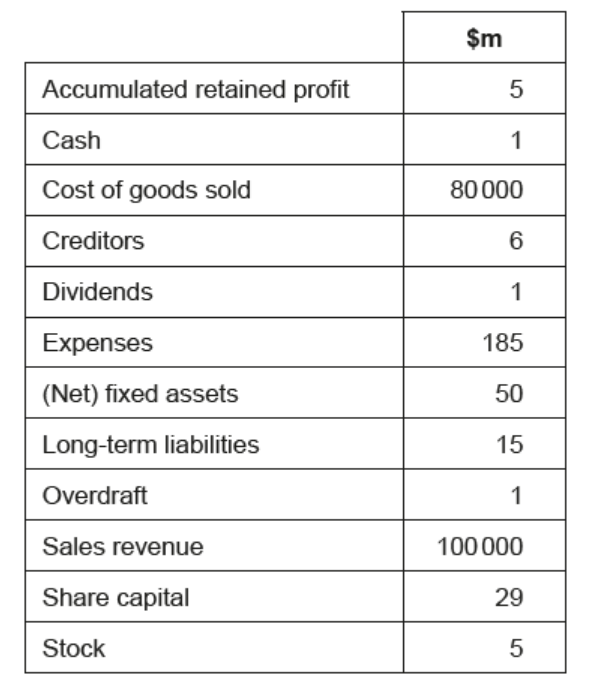

Table 2 provides selected financial data for RE from:

the profit and loss account for year ending 31 May 2021

the balance sheet as of 31 December 2021.

Table 2: Selected financial data for RE

The finance director is concerned about the trend in consumer preference for electric cars and the potential impact of increased numbers of electric cars on $R E$.

a. State two appropriate external sources of finance that $R E$ could use to modernize its gas stations.[2]

b.i. Construct a fully labelled balance sheet for $R E$ as of 31 December 2021 .[5]

b.ii.Calculate $R E$ ‘s gross profit margin (no working required).[1]

▶️Answer/Explanation

Ans:

a.Award [1] for each appropriate source of finance up to a maximum of [2].

Appropriate external sources include:

- share (capital)

- loan (capital) / bank loans

- retained profit

- debentures

- venture capital

- leasing

- equity finance.

Do not award inappropriate sources such as:

- trade credit

- overdrafts

- grants

- subsidies

- debt factoring

- hire purchase

- business angels

- partners

- entrepreneur.

b.i

N.B. if the candidate does not follow the IB prescribed format award a maximum of [3].

N.B. candidates should not be penalized for: omitting the row “Long-term liabilities (debt)”, or for writing “retained profit” omitting the word “accumulated”.

Award [1] if the candidate conveys some idea of what a balance sheet is.

Award [2] if the candidate constructs a largely recognizable balance sheet, but it does not balance, or it has two major problems of classification.

Award [3] for a largely accurate balance sheet that correctly balances. (There could be one misclassification.)

Award [4] if the candidate constructs an accurate balance sheet (that balances) according to the IB prescribed format.

Award [5] if the candidate constructs an accurate balance sheet (that balances) according to the IB prescribed format and the balance sheet is dated.

b.ii. $\$ 100000 m-80000 m=\$ 20000 m$

$

\frac{\$ 20000 \mathrm{~m}}{\$ 100000 \mathrm{~m}}=20 \%

$

Correct answer $=20 \%$ or .2

If a candidate does not express the gross profit margin (GPM) as a percentage or as a decimal, the answer is incorrect.

Award [1] for the correct answer (no working required).

Question

Wong Corporation (WC)

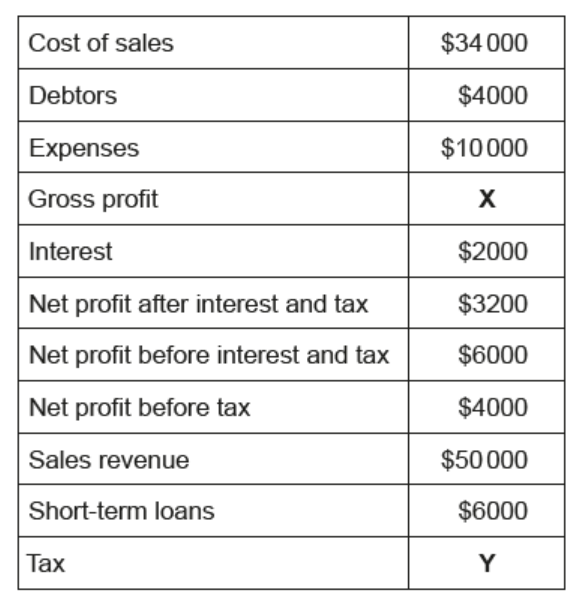

Wong Corporation (WC) manufactures clothes dryers. WC pays tax at a rate of $20 \%$. WC has a hierarchical organization structure. Table 3 shows selected forecasted financial information for the company for 2022, and Table 4 shows its annual cash flow forecast for 2022.

Table 3: Selected forecasted financial information for $W C$ for 2022 (all figures in $\$ 000$ s)

Table 4: Annual cash flow forecast for WC for 2022

(all figures in $000s)

b. Calculating $\mathbf{X}$ and $\mathbf{Y}$ in Table 3, prepare a profit and loss account for $W C$ for 2022 (show all your working).$[4]$

c. Using Table 4, calculate WC’s net cash flow for 2022 (show all your working).[2]

d. Explain the difference between WC’s profit and its cash flow.$[2]$