Question

Dan, a young entrepreneur, is planning to start his own small business making hand-made wooden garden benches – Beautiful Benches (BB).

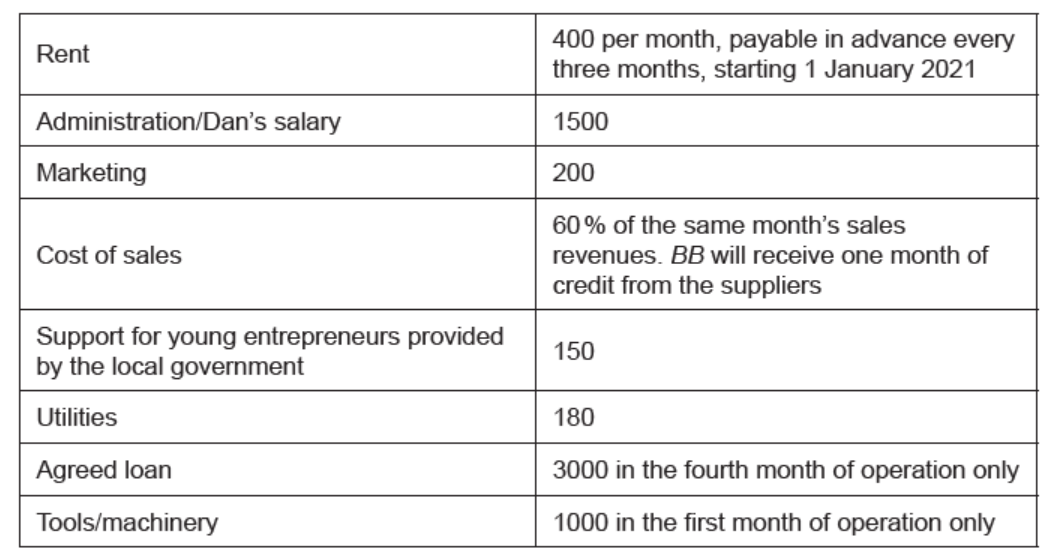

Table 2: Forecasted sales revenue for BB for the first four months

of operation, starting 1 January 2021 (all figures in $)

To be competitive, BB offers its customers credit. They pay 50 % when they buy a bench and 50 % one month later.

Table 3: Selected forecasted financial information for BB for 2021

(all figures in $ and per month unless stated otherwise)

Dan was advised to pay close attention to $B B$ ‘s working capital cycle.

a. Define the term working capital cycle.[2]

b. Prepare a monthly cash flow forecast for $B B$ for the first four months of operation.

c. Explain one strategy that $B B$ could use to significantly improve its forecasted cash flow for January 2021 .[2]

▶️Answer/Explanation

Ans:

a.

Working capital cycle is the period of time/interval between the actual cash paid for costs of production and the actual cash received from customers. It is the time period when net current assets is converted into cash. [2]

N.B.: no application required. Do not credit examples.

Award [1] for a basic definition that conveys partial knowledge and understanding but omits reference to’ time period’ or ‘cash’.

Award [2] for a full definition that conveys knowledge and understanding similar to the answer above.

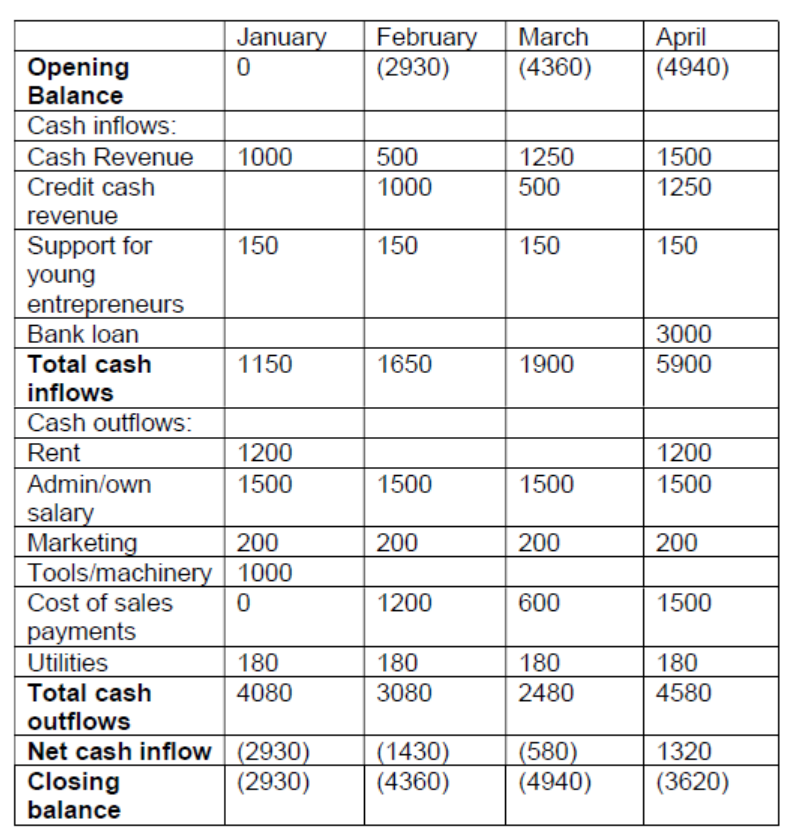

b.

Please note: Candidates do not have to split “cash revenue” and “credit cash revenue” or cost of sales and costs of sales on credit.

N.B. Allow candidate own figure rule (OFR): if a candidate makes an error in one row and carries it through the remainder of the forecast that is only one error. This provision includes both mathematical errors and conceptual errors (for example, if a candidate has the rent in the incorrect month then candidates should only lose [1] for that error.

Award [1] if the candidate conveys some understanding of what a cash flow forecast is, but otherwise the forecast is largely inaccurate, incomplete, or illegible.

Award [2–3] if a cash flow forecast is drawn, but either it is not in a generally accepted format or it is untidy, and/or the forecast contains three or more errors, which could include, in addition to number placement problems and mathematical errors, conceptual errors (using the word “profit” rather than “net cash flow”) or omissions, such as not having a line like “closing balance” or totals.

Award [4–5] if the cash flow forecast is drawn essentially correctly and neatly in a generally accepted format, but there is one error for [5] or two errors for [4]. Award [6] if the cash flow forecast is drawn accurately and neatly in a generally accepted format and is error free.

If the candidate provided a heading of total inflow/outflow without using another heading above of inflow or outflow – do not penalize as an omission.

If the candidate omitted both headings of outflow/inflow but does include ‘Total’ Cash Outflow/Inflow headings do not penalize.

Missing any of highlighted headings = one error

Substituting the term “net profit in the cash flow forecast for “net cash flow” is inaccurate and [1] should be deducted.

If the candidate has only one row for all cash outflows or inflows, subtract [1] from the total mark awarded.

Full working is not expected.

c.

It is expected that candidates identify the main figures/categories that contributed to the negative cash flow. Clearly the options are either to reduce the cash outflow or increase the cash inflow. Candidates should provide concrete examples as application. There is no need to reproduce a new cash flow. It is expected the relevant terminology is used. As generally total revenue is increasing, apart from February, it is not expected that candidates suggest to increase total revenue inflow using marketing etc.

Increase inflows:

Candidates may suggest that BB should not give credit for the first months of operation. This will increase the inflow by a $1000.

Dan can possibly ask the bank to give a loan in the first months of operation instead of the 4th months. $3000 will help BB to significantly reduce the initial negative cash flow.

Increasing the price of benches will increase inflows. However, this may reduce competitiveness.

Reduce outflows:

Dan can reduce his own salary of 1500, especially in the first month or so. Own salaries and admin are the most excessive/large outflow that contributes to the negative cash inflow. A smaller self-reward can significantly reduce the outflow and therefore the net cash flow.

Dan can also negotiate his rental payments. Instead of paying a large sum of 1200 in January, monthly instalments of $400 will significantly reduce the outflow in January Dan can also ask for at least one month’s credit from his landlord.

Do not accept an option of not buying the machinery/tools.

Accept lease the machinery for a considerably lower fee per months.

Generic comments like reduce donation, utilities etc will not make a significant impact. Hence not really applicable.

Award [1] for a relevant generic strategy identified or described and [1] for any additional explanation in context to BB.

[2] cannot be awarded for the strategy if the response lacks either explanation and/or application. Explanation needs to cover the effect the strategy is designed to produce. It is not enough just to say ‘reduce Dan’s salary’,

For example: For an identification or a description of the strategy like reduce cash outflow/ increase cash inflow without explanation or application [1].

For explanation of the strategy with no application [1].

For explanation of the strategy and application [2].

Question

Les Légumes Contentes (LLC)

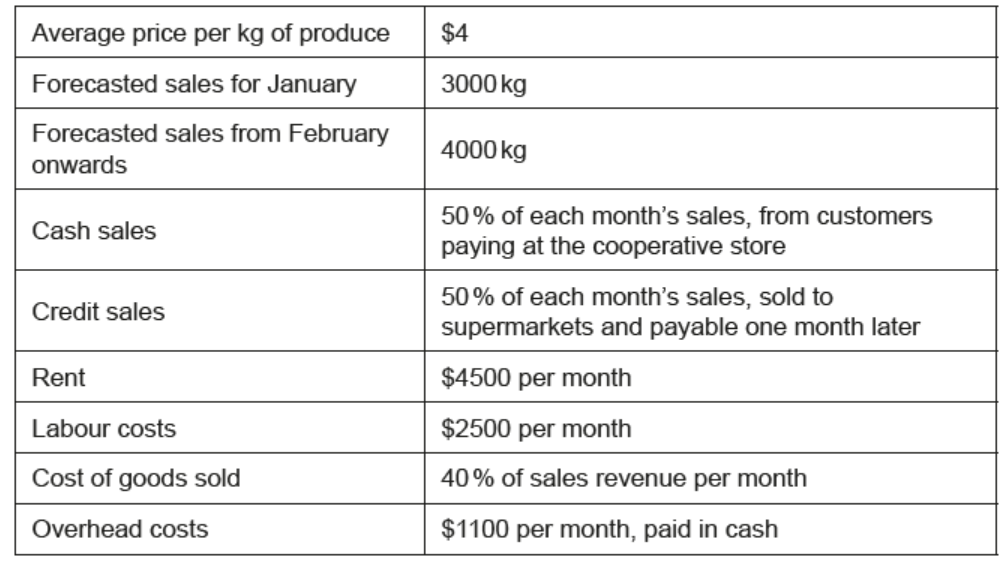

Les Légumes Contentes (LLC) is a cooperative of farmers that sells organic produce. LLC’s starting capital is $5000. It needs a bank loan to buy refrigerators for its store. The bank has requested a cash-flow forecast. The forecasted figures are shown in Table 3.

Table 3: Forecasted figures for LLC for the first four

months of operations, beginning 1 January

a. State two features of a cooperative.

b. Using Table 3 and the information provided above, prepare a monthly cash-flow forecast for LLC for the first four months of operations.

▶️Answer/Explanation

Ans:

a

Two features include:

A cooperative society works on the principle of sharing and welfare. If any surplus (or loss) is generated, it is distributed/shared amongst the members (shared profits or losses of members).

An elected managing committee has the power to take decisions. Members have the right to vote, by which they elect the members who will constitute the managing committee (shared decision-making between members).

There is limited liability of the members of a cooperative society. Liability is limited to the extent of the amount contributed by members as capital (limited liability of members).

Accept any other relevant feature.

An explanation is not required.

Award [1] for each correct feature stated. Award a maximum of [2].

Application is not expected.

N.B. Whilst the command term is “features” it is also true that some features may also be advantages.

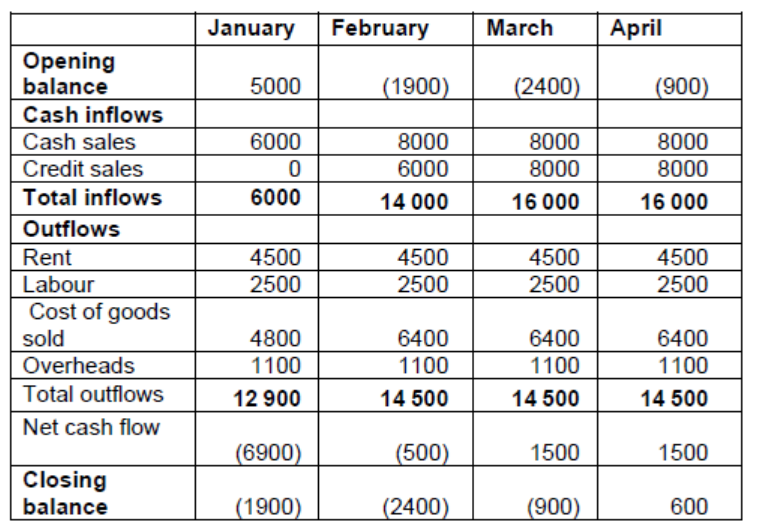

b.

N.B. Allow candidate own figure rule (OFR): if a candidate makes an error in one row and carries it through the remainder of the forecast, that is only one error. This provision includes both mathematical errors and conceptual errors (for example, if a candidate includes the credit sales for January in this month, it is one error) and candidates should only lose [1] for that error.

Award [1] if the candidate has some idea of what a cash-flow forecast is and looks like.

Award [2] for a cash-flow forecast that has some problems in layout and wording and which has more than three errors/mistakes (apply OFR), which could include in addition to number placement problems and mathematical errors, or conceptual errors, or omissions, such as not having a line like “closing balance”.

Award [3] for a largely correct cash-flow forecast that has some minor problems with layout, wording and calculations, which has three mistakes (apply OFR).

Award [4] for a largely correct cash-flow forecast that has some minor problems with layout and wording and which has up to two mistakes (apply OFR) or the candidate does not produce a mathematically correct cash flow.

Award [5] for a mathematically correct cash-flow forecast that has up to one calculation error, or some omission of the wording above.

Award [6] for a fully correct cash-flow forecast with a generally accepted format and lines for total inflows/receipts, total outflows/payments (or some other acceptable wording), a line for net cash flow/inflow, etc., and lines for opening and closing balance.

Substituting the term “net profit” in the cash-flow forecast for “net cash-flow” is inaccurate and [1] should be deducted.

Cash sales and credit sales need not be separated.