Question

Jill Anderson

Jill Anderson operates a restaurant. Although Jill’s meals are viewed as being excellent quality, sales are slowing. Jill is considering replacing existing meals with gluten-free meals. The following financial and forecast information is for the month of May 2018. Jill’s restaurant can only produce either existing or gluten-free meals.

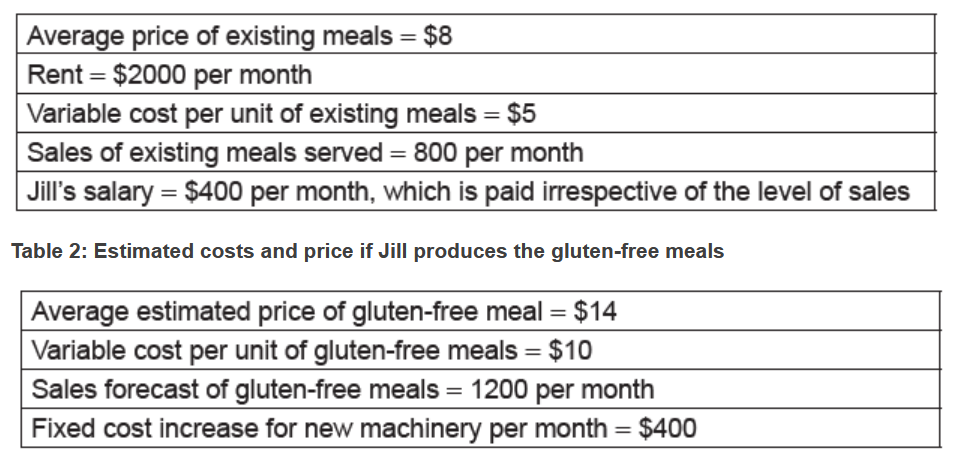

Table 1: Existing meals

A local gluten-free manufacturer, which is not part of Jill’s existing supply chain, has offered to supply already prepared gluten-free meals at $\$ 8$ per meal. Jill is unsure whether to make or buy the gluten-free meals.a. Define the term supply chain.[2]

b.i. Calculate:[2]

the total contribution of existing meals sold per month (show all your working).

b.ii.Calculate:

the total profit or loss on existing meals for May 2018 (show all your working).

b.iiiCalculate:

the forecast profit or loss if Jill decides to make and sell gluten-free meals (show all your working).

b.ivCalculate:

the contribution per unit of a gluten-free meal if Jill decides to buy-in the gluten-free meals (show all your working).

c. Using your answer from (b) (iii) and (iv), explain whether Jill should buy-in or make the gluten-free meals herself.[2]

▶️Answer/Explanation

Ans:

a. he term supply chain refers to a system, a process of organising people, activities, information and resources to move a product or service from supplier to customers/end users.

Award [1] if the definition is only partial or considers supply chain as the same as distribution channel.

Award [2] for a definition similar to the one above, which looks as supply chain as the whole mechanism of production from raw material purchase to final delivery.

b.i.

The contribution per unit of existing meals = $8 − $5 = $3

Number of meals sold = 800

Total contribution of existing meals sold per month = 800 × $3 = $2400

Award [2] for a correct final answer of $2400 with full working.

Award [1] for a correct answer without working.

Do not credit when only contribution per unit is presented as a final answer.

b.ii.

TR − TC = profit

$8 × 800 − [$2400 + $5 × 800]

$6400 − [$2400 + 4000]

$6400 − $6400 = 0

Accept any other method of working.

Candidates are not expected to set out their answer in this manner.

Award [1] for a correct answer with working. Candidates do not need to state that Jill is breaking even. (As the question asks for working)

b.iii.

NOTE FOR 2024 EXAMS ONWARD: Break even or Total Contribution calculation is expected with forecast profit. There is no requirement to produce a forecasted profit and loss account.

Contribution = $14 − $10 = $4 per meal

Total contribution = 1200 × $4 = $4800

Total forecast profit = 4800 − (2400 + 400 extra fixed cost for gluten meals)

Total forecast profit = $2000

OR

Profit = TR − TC

Profit = (14 × 1200) − (2800 + (1200 × 10))

Forecast profit = 16800 − 14 800

Forecast profit = $2000

Award [1] if there is one error in calculation, eg forgetting to add the extra fixed cost component, or the correct answer is given but there is no working.

Award [2] for both the correct answer and clear and suitable working.

b.iv.

The contribution per meal if Jill decides to buy-in = $14 − $8 = $6

Award [1] for the correct answer only with working shown.

c.

Buys in:

1200 × $14 − [2400 + 1200 × $8]

$16800 − [2400 + 9600]

$16800 − $12000

4800 profit

Which is $2800 higher than in (iii) – the cost to make with profit of $2000

Candidates do not have to repeat all of the working above if presented in the previous answers especially in (b)(iii).

Or:

Buys in:

12000 × $6 − 2400 (using contribution method)

$16800 − [2400 + 9600] $7200 − $2400= $4800 profit

$16800 − $12000

$4800 profit

Which is $2800 higher than the profit of $2000 if she makes them herself in part (iii).

Accept any other method.

Given the nature of the question regarding reference to (b)(iii) and (iv) it is expected that the candidates incorporate references to the change in contribution and or profit

Award [1] for just using the extra contribution to support but without reference to/ or calculation of profit before and after.

Award [1] for a response that mentions some relevant qualitative issues with reference to or comparison with the option to make.

Award [2] for a correct numerical answer with some references to the exact figures of profit before and after.

Do not credit a response that just says that Jill should accept the offer without any calculation or reference to profit or contribution when buying.

Please note:

Some candidate just referred to a fall in fixed cost- not to contribution or profit. Do not award.

Do not credit a response that does not demonstrate some attempt to calculate the option of buying or refer to profit after buying.

Allow OFR