Question

Anubis

Tom operates Anubis as a sole trader, selling cell/mobile phone cases on the internet. The market is increasingly competitive. The retail price of phone cases is predicted to fall in the second quarter of 2018. Employees at Anubis will receive a $3 \%$ rise in wages starting from 1 April 2018.

Tom has forecasted the following monthly cash outflows for January through March 2018 :

- Heating and lighting: $\$ 4000$.

- Wages: \$50 000.

- Packaging: \$15 000.

- Delivery charges: $5 \%$ of sales revenue.

- Cost of goods sold: $\$ 220000$.

Additional information:

- Opening balance on 1 January 2018: $\$ 8000$.

- Sales revenue: $\$ 300000$ each month.

- Rent of $\$ 2000$ paid quarterly: first payment in January 2018.

- Receipt of a tax refund in February 2018: \$3000.

a. Outline two appropriate external short-term sources of finance for Anubis other than loans from family and friends.[2]

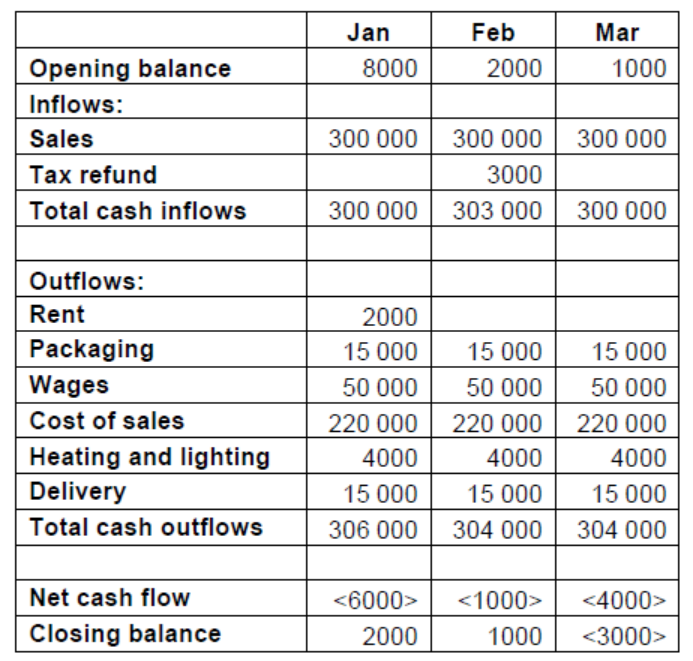

b. Using the information above, prepare a fully labelled cash-flow forecast for Anubis from January to March 2018.[5]

c. Comment on the predicted cash flow for Anubis for 2018.[3]

▶️Answer/Explanation

Ans:

a. The sources of finance suggested must be external and short term – therefore the only four rewardable answers are:

- Trade credit

- Factoring

- Overdraft

- Short-term bank loan

Award [1] per correct source identified up to a maximum of [2]. However, if a candidate outlines overdraft and short-term bank loan, maximum award [1].

Award [1] per correct source identified up to a maximum of [2].

b.

Award [1] if the candidate has some idea of an annual cash-flow forecast but otherwise has numerous errors. Award [2] if the cash flow has three or more errors or has a largely inaccurate format. Award [3] if it is largely formatted correctly and/or has two errors. Award [4] for a correctly formatted forecast with just one error. Award [5] for a correctly formatted and mathematically correct forecast.

The cash flow forecast is a cause for concern. The forecast covers the first three months of 2018 but the closing balance worsens each month and is forecasted to be negative in March. Thereafter, Anubis faces lower gross profit margin because of lower retail prices of phone cases and higher wages costs. Given that the market is increasingly competitive, Anubis may not be able to generate sufficient additional sales revenue to offset the lower gross profit margin. Thus, the situation for Anubis is not promising.

Award [1] for recognition that the business’s cash flow position is predicted to deteriorate.

Award [1] for each additional relevant comment related to the stimulus and specifically referring to it, up to [2]. Maximum award: [3].

N.B. The candidate’s commentary should be based upon the cash flow numbers that were produced in 2(b). Examiners should follow a procedure similar to the Own Figure Rule. Even if the candidate’s cash flow numbers are extremely inaccurate, the candidate can still comment on them. The comment should be logically dependent on the numbers produced in 2 (b).