IB Mathematics AI SL Amortization and annuities using technology Study Notes - New Syllabus

IB Mathematics AI SL Amortization and annuities using technology Study Notes

LEARNING OBJECTIVE

- Amortization and annuities using technology.

Key Concepts:

- Amortization and annuities

- IBDP Maths AI SL- IB Style Practice Questions with Answer-Topic Wise-Paper 1

- IBDP Maths AI SL- IB Style Practice Questions with Answer-Topic Wise-Paper 2

- IB DP Maths AI HL- IB Style Practice Questions with Answer-Topic Wise-Paper 1

- IB DP Maths AI HL- IB Style Practice Questions with Answer-Topic Wise-Paper 2

- IB DP Maths AI HL- IB Style Practice Questions with Answer-Topic Wise-Paper 3

Amortisation

♦ Definition

Amortisation is the process of gradually paying off a debt with regular payments, where each payment is divided between the principal amount and the interest.

♦ The formula for the monthly payment \(P\) for an amortised loan of principal \(A\), with interest rate \(r\) and term \(n\) is:

\(P=\frac{rA}{1-(1+r)^{-n}}\)

♦ The total amount paid over the term of the loan is nP, and the total interest paid is

$nP − A$

♦ Formula for Monthly Payment \(P\)

\(P = \frac{rA}{1 – (1 + r)^{-n}}\)

Where:

\(A\) = Loan principal

\(r\) = Monthly interest rate (annual rate ÷ 12)

\(n\) = Total number of payments

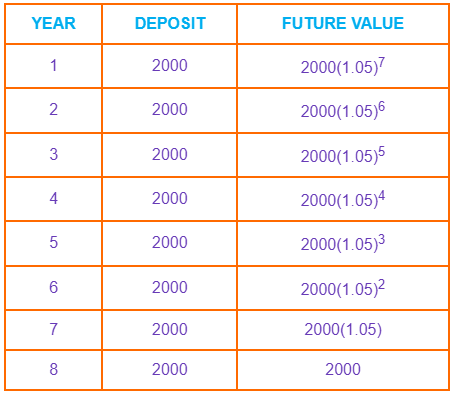

Example You invest $2000 at the end of each year, for 8 years, at a fixed interest rate of 5%. What will be the value at the end of the 8 years? Show each year values. ▶️Answer/ExplanationSolution: The $\$2000$ deposited each year earns interest for a different number of years:

So the total future value is: $FV = 2000(1.05)7 + 2000(1.05)6 + 2000(1.05)5 + … + 2000$ This is a geometric series where: First term \(u = 2000\), Common ratio \(r = 1.05\), Number of terms \(n = 8\). $S_n = u \cdot \frac{r^n – 1}{r – 1} = 2000 \cdot \frac{(1.05)^8 – 1}{0.05} \approx 2000 \cdot 9.549 = 19098.59 $ Final value of the annuity $≈ \$19098.59$ |

Example Loan: \$10,000 for 5 years at 6% annual interest. Total Paid: Total Interest: ▶️Answer/ExplanationSolution: \(P = \frac{(0.06/12) \times 10,000}{1 – (1 + 0.06/12)^{-60}} \approx \$193.33\) |

Annuities

An annuity is a series of equal periodic payments made at the end of each period.

♦ Present Value (\(PV\)) of an Ordinary Annuity:

\(PV = \frac{P}{r} \left[ 1 – \frac{1}{(1 + r)^n} \right]\)

♦Future Value (\(FV\)) of an Ordinary Annuity:

\(FV = P \cdot \frac{(1 + r)^n – 1}{r}\)

Example Deposit: $\$500$ monthly at 4% annual interest for 5 years. Calculate the Final Balance. ▶️Answer/ExplanationSolution: \(FV = 500 \cdot \frac{(1 + 0.04/12)^{60} – 1}{0.04/12} \approx \$33,163.62\) |

Note: The TI-84 Plus calculator can be used to solve for payment, present value, or future value of an annuity using the TVM Solver function.

Graphic Display Calculator TI-84 Plus Codes

♦The TVM (Time-Value-of-Money) Solver in TI-84 Plus is a useful tool for calculating compound interest problems.

Example Using the GDC You invest $5000 in a savings account with an annual interest rate of 5%, compounded monthly, Calculate the value of your investment after 10 years. ▶️Answer/ExplanationSolution: Step 1: Step 2:

Note: Ensure that P/Y and C/Y are both set to 12, since interest is compounded monthly. Step 3:

|

♦Code:

APPS → TVM Solver

Enter:

N = 120I/Y = 5PV = -5000PMT = 0FV = ?P/Y = 12,C/Y = 12

Move to

FV, pressALPHA→ENTERResult:

FV = $8,235.05